Why Paragraph 12 Trips Up Agents

If you’ve ever read Paragraph 12 in a Texas real estate contract and felt your eyes glaze over, you’re not alone. Even experienced agents get turned around here and for good reason. The language blends settlement costs, commission structures, and payment logistics, all in a few short lines. Add in the fact that commission agreements between brokers, seller concessions, and buyer-paid fees often happen in overlapping conversations, and you’ve got the perfect recipe for confusion.

As a transaction coordinator at Capital City Coordination, all of our transaction coordinators are seasoned Realtors®, some with a Broker License and some with over 24 years of Real Estate experience. Our role is to keep the details straight so agents can focus on their clients. In this post, we’ll break down Paragraph 12 in plain English, use the Texas REALTORS® flowchart as our guide, and walk through real-life scenarios. By the end, you’ll know exactly what goes where and more importantly, why.

What Paragraph 12 Is Really About

Paragraph 12 of the Texas sales contract is labeled “Settlement and Other Expenses”, and for our purposes, the part that creates the most confusion is 12A(1)(b).

This is where the contract outlines who pays what toward buyer’s expenses and specifically, how any contribution to the buyer’s broker’s fee is documented.

Think of Paragraph 12 as the “financial roadmap” between parties for expenses outside the sales price. It’s also where a misstep can cause:

- A mismatch between what was promised and what’s in writing.

- A delay at the title company because the paperwork doesn’t match.

- A frustrated buyer or seller when expectations don’t line up with reality.

The Flowchart: A Step-by-Step Approach

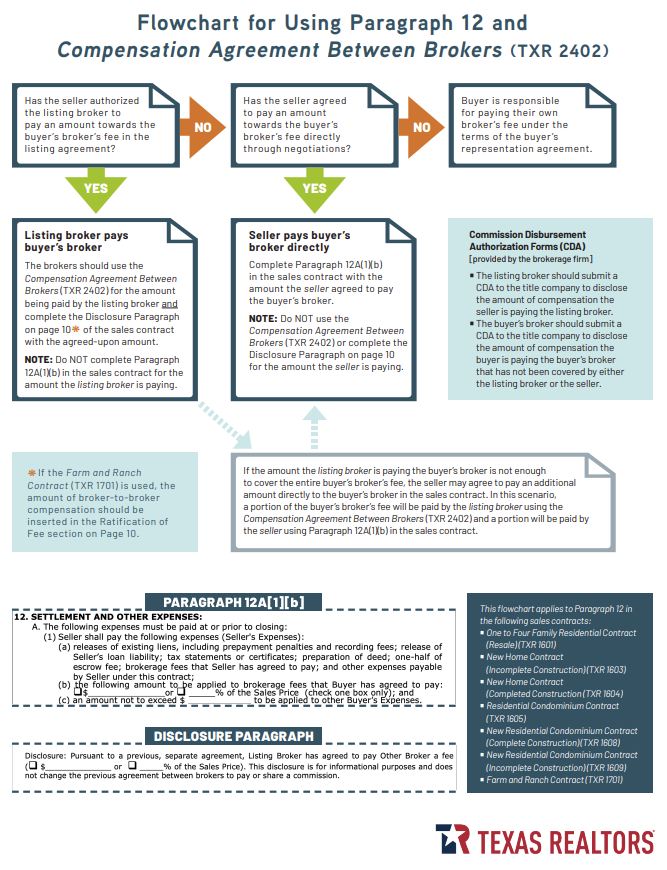

The Texas REALTORS® flowchart (which we’re linking here) takes what could be a wall of legal text and turns it into a “choose your own adventure” path for deciding how to handle the buyer’s broker’s fee.

Here’s the breakdown from the transaction coordinator perspective:

Step 1: Did the Seller Authorize the Listing Broker to Pay the Buyer’s Broker in the Listing Agreement?

- YES → You’ll use the Compensation Agreement Between Brokers (TXR 2402) to document the amount.

- NO → Move to Step 2.

TC Tip: This step happens before the contract is even signed . Make sure you check the listing agreement early. This prevents scrambling later when the seller says, “Wait, I didn’t agree to that.”

Step 2: Did the Seller Agree to Pay the Buyer’s Broker Directly Through Negotiations?

- YES → Enter the amount in Paragraph 12A(1)(b) of the contract.

- NO → The buyer is responsible for paying their own broker under the buyer representation agreement.

TC Tip: If this happens during negotiations, always confirm the number in writing between both agents before amending the contract. A simple miscommunication here can cause post-closing headaches.

Step 3: Special Scenarios

Sometimes, the listing broker is paying part of the buyer’s broker fee, and the seller is paying the other part. In that case:

- The broker-to-broker payment still uses TXR 2402 and the Disclosure Paragraph (page 10 of the contract).

- The seller’s direct payment is recorded in Paragraph 12A(1)(b).

Why the Disclosure Paragraph Matters

The Disclosure Paragraph (toward the end of the sales contract) is where you state, for transparency, that the listing broker has agreed to pay part of the buyer’s broker’s fee. It’s informational, not negotiable, but leaving it blank when it applies can cause a compliance flag.

If you’re using the Farm and Ranch Contract (TXR 1701), broker-to-broker compensation goes in the Ratification of Fee section instead.

Common Mistakes Agents Make

After coordinating hundreds of transactions, here are the repeat offenders:

- Putting the Listing Broker’s Payment in Paragraph 12

- If the payment is from broker to broker, it belongs in TXR 2402 and the Disclosure Paragraph, not 12A(1)(b).

- Forgetting to Use TXR 2402 Altogether

- This form is critical when one broker is compensating another outside of the sales contract.

- Mixing Up Seller-Paid Concessions and Broker Compensation

- Seller concessions for buyer closing costs go in 12A(1)(b), but not if they’re actually broker compensation.

- Not Matching the CDA to the Contract

- Title companies rely on Commission Disbursement Authorizations (CDAs). If the CDA doesn’t reflect the agreement in the contract and TXR 2402, closings can be delayed.

- Title companies rely on Commission Disbursement Authorizations (CDAs). If the CDA doesn’t reflect the agreement in the contract and TXR 2402, closings can be delayed.

Practical Example Example 1: Broker-to-Broker Payment

- Seller lists with ABC Realty, agrees in the listing agreement that ABC will pay XYZ Realty (buyer’s broker) $6,000.

- This gets documented in TXR 2402 and the Disclosure Paragraph.

- Paragraph 12A(1)(b) stays blank for broker fees.

Practical Example Example 2: Seller Direct Payment

- Seller does not authorize payment in the listing agreement, but during negotiations agrees to give $3,000 toward the buyer’s broker’s fee.

- This $3,000 goes in Paragraph 12A(1)(b).

- TXR 2402 is not used.

Practical Example Example 3: Split Payment

- Listing broker pays $4,000 (via TXR 2402 and Disclosure Paragraph).

- Seller pays $1,000 directly to the buyer’s broker in Paragraph 12A(1)(b).

Links You’ll Want Handy

Here are resources we recommend bookmarking for quick access:

- Flowchart for Using Paragraph 12 & Compensation Agreement Between Brokers (TXR 2402) – A clear, visual guide for when to use TXR 2402 vs. Paragraph 12A(1)(b)

- TREC Contracts and Forms

- Texas REALTORS® Forms Description & Reference

- Texas REALTORS® How to use Paragraph 12

Best Practices for Agents (From a TC Who’s Seen It All)

- Clarify Before the Offer is Signed

Never assume the listing agreement covers compensation, verify before the buyer submits an offer. - Use the Correct Forms

TXR 2402 is your friend. So is the contract’s Disclosure Paragraph. - Keep the CDA in Sync

Coordinate with the title company to ensure their disbursement matches the contract and broker agreements. - Double-Check Page 10

Whether it’s the Disclosure Paragraph or Ratification of Fee, make sure the right info is in the right place. - Educate Your Clients

Even if they don’t need all the legal details, explaining why something is in Paragraph 12 can help avoid tension later.

Final Thoughts

Paragraph 12 doesn’t have to be a stumbling block. When handled correctly, with the right forms, accurate entries, and clear communication, it protects everyone in the transaction and ensures the closing table is smooth sailing.

As transaction coordinators at Capital City Coordination, our job is to keep the moving pieces in sync, so you can focus on relationships, negotiations, and growing your business.

If you’ve got a tricky Paragraph 12 situation coming up, reach out. We’ve probably seen it before and we know how to get it across the finish line without a hitch.

Follow us on Social Media!